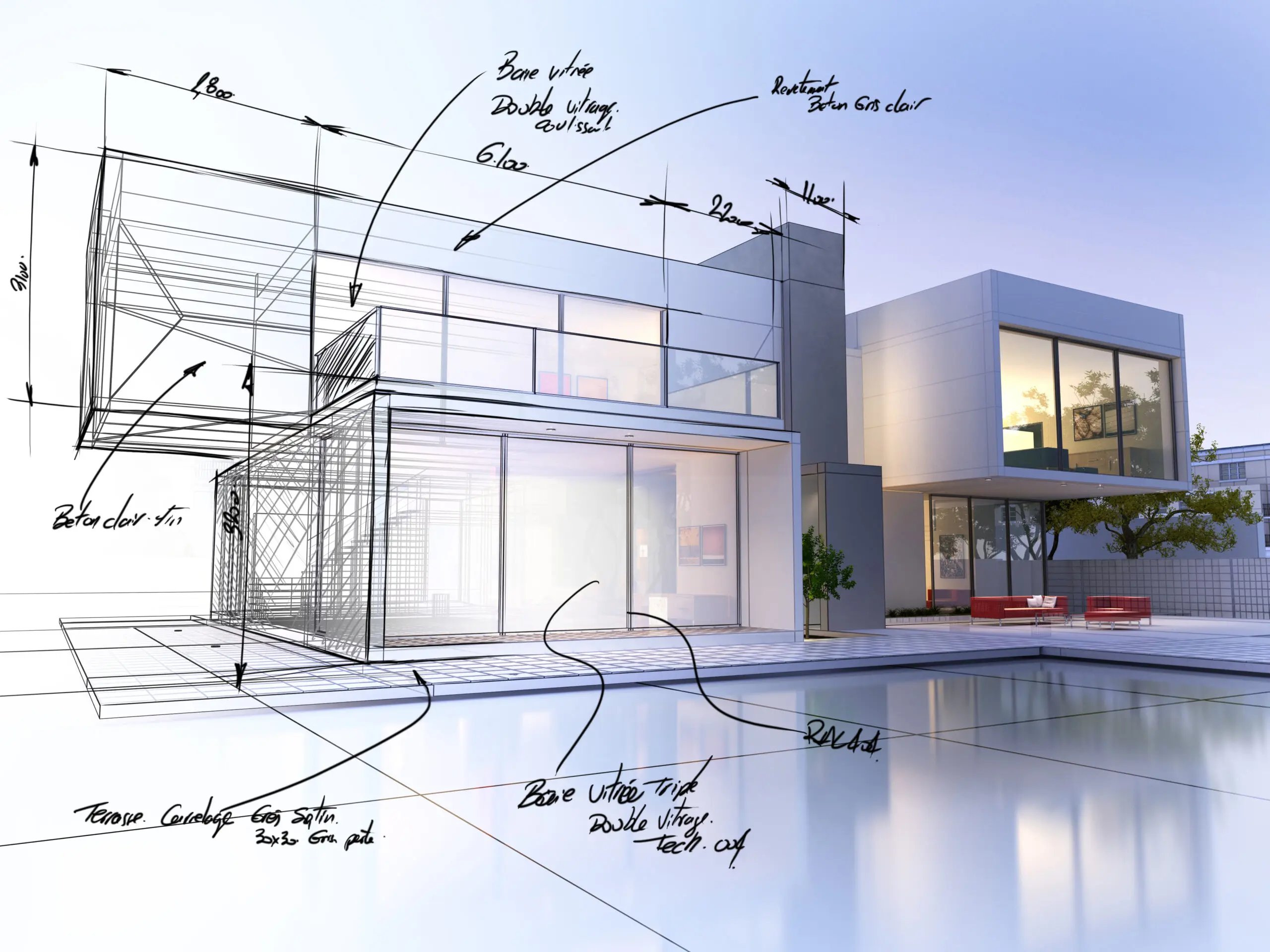

Self-Build and Construction Mortgages

Looking for financial help to build your dream property? A Spanish self-build mortgage could be your answer!

Looking for a self-build mortgage? We can help!

If you’re looking to build your dream home in Spain, Fluent Finance Abroad can help you consider all of the options available to help you achieve your dream.

Although securing a self-build or construction mortgage (hipoteca autopromotor) is considerably more complex than a residential mortgage, Fluent Finance Abroad can offer you professional guidance and advice to help you navigate the rules and regulations involved in securing a construction mortgage.

Construction mortgages are available to both Spanish residents and non-residents alike and are available on both fixed and variable terms. However all applicants have to provide the bank with considerable details regarding the build, demonstrating that relevant licences have been granted , the architects plans have been approved and that quotes and costs for the build are available.

Looking for a self-build mortgage? We can help!

In the vast majority of cases banks will only offer a mortgage for the build if you own the plot of land outright, although in more rare cases others will offer a mortgage on the land and a separate mortgage for the construction. And unlike a traditional residential mortgage, you won’t receive the loan as a lump sum at the start of the build, as the payments are released at various stages during the construction process.

Designing and building your own home is both exciting and rewarding, and with expert mortgage advice from Fluent Finance Abroad we can help you to secure the right financing for your dream home.

Contact us now - our expertise is unbeatable!

Call us now to find out more about Spanish Self-Build and construction mortgages. Speak with a Fluent Finance Abroad Spanish Mortgage expert on 0034 952 85 36 47, or we can discuss your requirements via Zoom or Teams.

If you prefer email contact us on info@fluentfinanceabroad.com, or fill out our online enquiry form and one of our friendly team will contact you.

"Clear and concise communication between clients and lenders is critical to this business"

Marc Elliott de Lama

Marc Elliott is the British expat and brains behind Fluent Finance Abroad, the Spanish mortgage brokers based in San Pedro de Alcántara, Marbella.

Latest News

Check out the latest news from Fluent Finance Abroad

Buying Rural Property in Spain

Is investing in a beautiful country house in the idyllic Spanish countryside something you’ve always dreamt of? Living in the ...

What is ETIAS, and do I need it?

If you plan on visiting Europe towards the backend of next year or beyond, now would be a great opportunity ...

Where are the best places to visit in Spain during the shoulder season?

Taking advantage of the perks of shoulder season in Spain is a no-brainer for those who can. This period offers ...

Frequently Asked Questions

What is a self-build or construction mortgage in Spain?

Self-build mortgages, also known as construction mortgages, are specialised bank loans that finance the building of a property from scratch.

A self-build mortgage differs from a traditional mortgage as the funds provided for construction aren’t released as an initial lump sum. Instead, the money is released bit by bit based on the progression of building work.

Do I need to own the land outright before applying for a construction mortgage?

Generally, yes. Most banks in Spain will only offer a self-build mortgage if you own the land you intend to construct your house on. The land must also be fully registered in your name.

However, some banks may finance land purchase and construction together. But this usually only happens if you arrange them together and provide full project details, including licences and planning.

On the whole, most people buy the land first before applying for the construction mortgage.

How are the funds released?

Unlike a regular mortgage, where you receive a lump sum loan, the funds are released in stages throughout the construction process. The money is supplied in accordance with reports from the architect, and the final payment is made after construction has ceased.

What documentation is required to apply for a self-build mortgage?

In addition to the documentation you would need to supply for a traditional mortgage, such as a colour copy of your passport and bank statements, you’ll also need:

- Nota Simple for bought land

- Build licences

- Architect’s report

- Quotes from construction firms

For more guidance, get in touch with our mortgage specialists today.